Exploring the Long-Term Benefits and Importance of Risk Management for Startups

Exploring the Long-Term Benefits and Importance of Risk Management for Startups

Blog Article

Exploring the Relevance of Risk Management for Effective Decision-Making Strategies

In the detailed globe of organization, Risk Management arises as an important aspect in the decision-making procedure. The capacity to determine prospective threats and possibilities, and strategize accordingly, can spell the distinction in between success and failure.

Comprehending the Principle of Risk Management

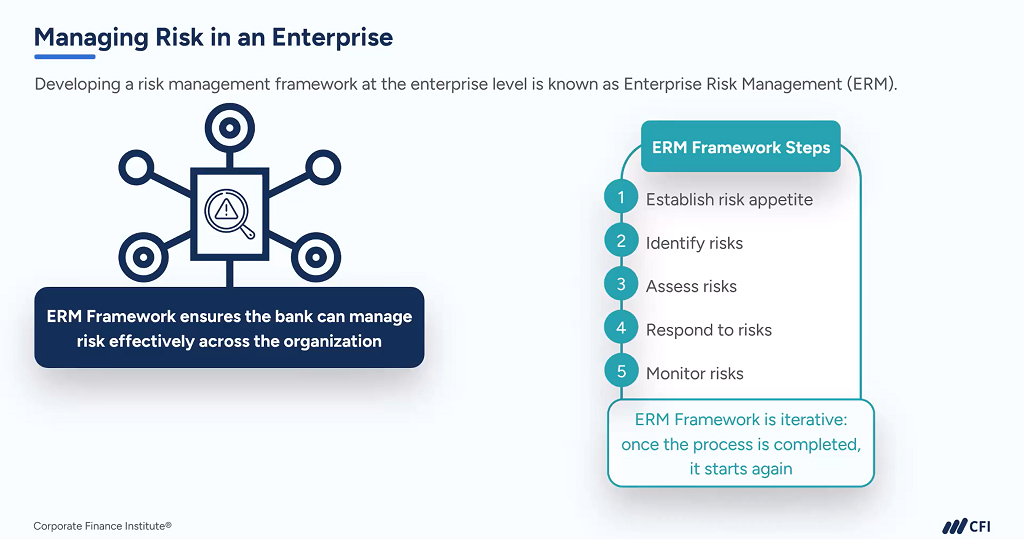

Risk Management, a crucial part in decision-making, is often misinterpreted or oversimplified. Usually, it refers to the identification, evaluation, and prioritization of dangers to reduce, keep an eye on, and regulate the likelihood or impact of unfortunate events. However, it's not simply regarding protecting against negative outcomes, yet additionally regarding acknowledging prospective opportunities. Risk Management involves regimented and structured methods, utilizing information and informative evaluations. It needs a detailed understanding of the organization's context, goals, and the prospective dangers that could obstruct them. From financial unpredictabilities, legal liabilities, tactical Management mistakes, to crashes and natural catastrophes, it resolves numerous risks. Importantly, efficient Risk Management is not stagnant; it's a constant, positive procedure that evolves with altering scenarios.

The Duty of Risk Management in Decision-Making Processes

In the world of calculated planning and organization procedures, Risk Management plays an integral duty in decision-making processes. It helps in determining potential risks and uncertainties that might affect the accomplishment of organization objectives. By tracing these dangers, business can create techniques to mitigate their impact, making sure business continuity and stability. Risk Management therefore comes to be a vital device in decision-making, helping leaders to make informed choices based upon a thorough understanding of the risks entailed. It motivates an aggressive method, allowing companies to anticipate and prepare for possible future scenarios. This significantly minimizes the possibility of adverse effects, advertising much more reliable and reliable decision-making approaches. Risk Management serves as an important part in the decision-making procedures of any type of organization.

How Risk Management Improves Strategic Planning

In the context of calculated preparation, Risk Management plays a pivotal role. Initiating with the recognition of possible dangers, it even more includes the execution of Risk reduction actions. The duty of Risk Management is vibrant yet not fixed, as it demands constant surveillance and adjusting of methods.

Determining Prospective Threats

Applying Risk Mitigation

Risk reduction methods can range from Risk evasion, Risk transfer, to run the risk of decrease. Each approach ought to be tailored to the certain Risk, considering its possible article effect and the organization's Risk tolerance. Effective Risk mitigation needs a deep understanding of the Risk landscape and the possible effect of each Risk.

Monitoring and Adjusting Approaches

Though Risk mitigation is a critical step in strategic planning, constant monitoring and change of these approaches is equally vital. It likewise gives an opportunity to assess the success of the Risk Management measures, permitting modifications to be made where essential, more boosting critical planning. Monitoring and changing Risk Management methods is a crucial element for improving a company's strength and critical preparation.

Instance Studies: Successful Risk Management and Decision-Making

On the planet of business and financing, successful Risk Management and decision-making typically work as the pillars of flourishing ventures. One such entity is a multinational oil firm that minimized financial loss by hedging versus varying oil costs. In an additional instance, a technology start-up flourished by recognizing and accepting high-risk, high-reward approaches in an unstable market. A global bank, confronted with governing uncertainties, successfully navigated the situation via positive Risk analysis and vibrant decision-making. These cases highlight the worth of sharp Risk Management in decision-making processes. It is not the absence of Risk, but the Management of it, that frequently differentiates successful business from not successful ones. These situations highlight the essential role of Risk Management in strategic decision-making. importance of risk management.

Tools and Methods for Efficient Risk Management

These devices, such as Risk signs up and warmth maps, help in recognizing and assessing possible risks. Risk feedback techniques, a key part of Risk Management, entail accepting, avoiding, transferring, or mitigating risks. With these devices and strategies, decision-makers can browse the facility landscape of Risk Management, thereby promoting notified and effective decision-making.

Future Patterns in Risk Management and Decision-Making Techniques

As we explore the vast landscape of Risk Management, it comes to be apparent that the methods and devices utilized today will continue to develop. The principle of Risk society, where every member of a company is mindful and entailed in Risk Management, will certainly get much more prominence. These trends proclaim a more comprehensive and proactive method towards Risk Management and decision-making.

Conclusion

Risk Management hence comes to be a vital device in decision-making, aiding leaders to make enlightened options based on a thorough understanding of the risks involved. Risk mitigation techniques can vary from Risk evasion, Risk transfer, to run the risk of decrease (importance of risk management). Efficient Risk reduction click this link calls for a deep understanding of the Risk landscape and the possible influence of each Risk. Risk response techniques, a key part of Risk Management, involve approving, avoiding, transferring, or mitigating threats. The principle of Risk society, where every participant of a company is aware and included in Risk Management, will acquire extra importance

Report this page